The Mortgage Bankers Association (MBA) publishes the results of a weekly applications survey that covers roughly 50 percent of all residential mortgage originations and tracks the average interest rate for 30 year and 15 year fixed rate mortgages, 1 year ARMs as well as application volume for both purchase and refinance applications.

The Mortgage Bankers Association (MBA) publishes the results of a weekly applications survey that covers roughly 50 percent of all residential mortgage originations and tracks the average interest rate for 30 year and 15 year fixed rate mortgages, 1 year ARMs as well as application volume for both purchase and refinance applications.The purchase application index has been highlighted as a particularly important data series as it very broadly captures the demand side of residential real estate for both new and existing home purchases.

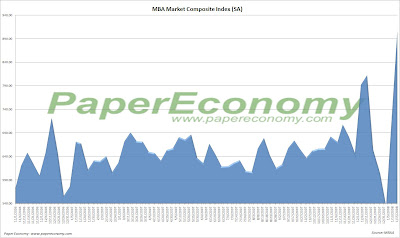

The latest data is showing that the average rate for a 30 year fixed rate mortgage decreased since last week to 5.62% while the purchase volume increased 11.4% and the refinance volume increased a whopping 43.4% compared to last week’s results.

Again, as I had noted in prior MBA posts, seasonally adjusting a weekly data series becomes problematic surrounding the holiday weeks so today’s results should be viewed with some caution as the erratic movements since December should even out a bit over the next few weeks.

There is no doubt that the average fixed mortgage rate is now materially below the trend of 2007 and increases to loan volume will reflect that but it will take a few weeks for the underlying trend to become clear.

Also note that the average interest rates for 80% LTV fixed rate mortgages has now dropped firmly below the mean for the prior year and that the interest rate for an 80% LTV 1 year ARM continues to be elevated with a 15 basis point spread above the 30 year fixed rate.

It’s important to note that the data is reported (and charted) weekly and that the rate data represents average interest rates, and the index data represents mortgage loan application volume for home purchases, home refinances and a composite of all loans.

The following chart shows how the principle and interest cost and estimated annual income required to cover the PITI (using the 29% “rule of thumb”) on a $400,000 loan has changed since January 2007.

The following chart shows the average interest rate for 30 year and 15 year fixed rate mortgages over the last number of weeks (click for larger version).

The following chart shows the average interest rate for 30 year and 15 year fixed rate mortgages over the last number of weeks (click for larger version).

The following charts show the Purchase Index, Refinance Index and Market Composite Index since January 2007 (click for larger versions).

The following charts show the Purchase Index, Refinance Index and Market Composite Index since January 2007 (click for larger versions).