The National Association of Realtors (NAR) recently published an awkward series sound-byte video clips that were taken from an address given by their current President Pat Vredevoogd Combs, speaking at an NAR press conference.

In the clips, Combs is initially seen reiterating the now tired “It a Great Time to Buy” mantra as well as outlining additional details of the newly launched ad campaign that as Combs notes will be running throughout the year on both radio and television.

“Most consumers today understand that home ownership is a safe, secure way to build long term wealth.” states Combs adding “What consumers need more help understanding is how, or when to buy or sell… That’s where Realtors really make a difference in the marketplace.”

“Now may be the best time to buy a home in more than six years. In most real estate markets around the country ample inventory and near record low interest rates have created the best conditions for buyers that we have seen since the beginning of the real estate boom in 2001.”

It’s an interesting precedent to note that, at this point, NAR has declared that prices have stabilized rather than simply insinuating that they might be in the process of stabilizing.

Combs goes on to suggest that, “Realtors expertise and experience in their marketplace are invaluable in the current real estate environment of increased inventories, stabilizing prices and historically low interest rates.”

“As we enter a new year, signs that the real estate market is changing are everywhere. Sales were up in November for the second straight month, the first back-to-back sales gain since the spring of 2005. NAR Chief Economist David Lereah believes that the lowest point for the current cycle may have been reached in September and we are now in the early stages of recovery. By the end of the first quarter, with the opening of home buying season, we expect to see a new level of confidence to the real estate markets.”

In this way, the function of the NAR presents a unique scenario to say the least.

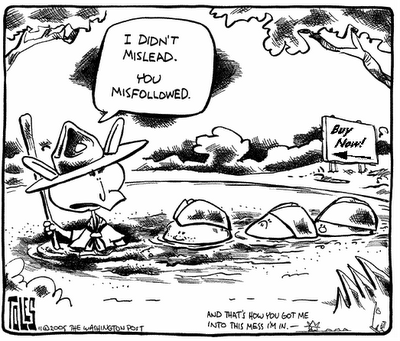

Not only do they publish some of the most important residential real estate economic indicators but after their Chief Economist conveys his “fuzzy” interpretation to a willing media (especially business media) their president then can freely blur the lines even further by interpreting the economist.

Clearly, a showdown of epic proportions is now brewing.

In the likely event that the spring market is similar or worse than last year, all this hubbub about market stabilization will be out the window and the NAR will be left looking plainly absurd and obviously in denial to virtually any sensible onlooker.

housing+bubble housing bubble realtor real+estate nationa+association+of+realtors NAR recession economy economics bernanke greenspan homebuilder loan ARM+loan toxic+mortgage mortgage

Copyright © 2007

PaperMoney Blog - www.paperdinero.com

All Rights Reserved

Disclaimer