As we now know all too well, 2006 was the first complete year of a national housing downturn that is generally known to have begun its descent back in June of 2005.

Although having shown a significant pullback in sales in many markets during the fall selling season, 2005 was such a strong year for housing overall that it seemed to leave many observers with a false sense of security as to the outlook for 2006.

Many industry experts sensed a slowdown was immanent, but the existence of a bubble condition and the extent to which a resultant decline would materialize

was still hotly contested even by veteran economists.

Some even suggested that with some “

new math”, the housing bubble scenario could be completely reasoned away in favor of an alternative view that would assert that many of the county’s hottest housing markets were at fair value or even cheap.

But as the year wore on, many found it harder and harder to maintain any confident position that would suggest that housing was not experiencing a major slowdown and the debate gradually shifted to the impact that it might have.

Additionally, and somewhat quietly,

the Federal Reserve cautioned homeowners not to expect Fed to rescue the housing market and that in fact, the tools that the Federal Reserve has at its disposal are far more effective at cleaning up after a financial collapse than preventing it from occurring.

With the housing market continuing to loose steam and home sellers on their own and feeling the strain, August arrived bringing with it the first major turning point of the year.

The results of the spring selling season were in and the story they told was as plain as day; sales had

literally plummeted for

new and

existing homes, inventory had reached record levels, purchases of

Saint Joseph statues were skyrocketing in many of the former “hot” markets, foreclosures were on the rise, and accounts of widespread new construction cancellations circulated while

home builders shed land parcels in record numbers.

The

traditional media was now

ablaze with stories about the housing market and in particular

home sellers hitting upon hard times.

Even the National Association of Realtors (NAR) had to concede before they appeared to be totally disconnected from reality.

During the NAR’s yearly leadership conference, Chief Economist David Lereah gave a presentation entitled “

Reality Check” in which was covered virtually every point that could possibly be made to support the argument that a housing bubble did in fact exist and that it was in the process of deflating in a dramatic and unprecedented way.

Upon entering the fall, it was plainly obvious that the nations housing market was in for a far more significant decline than many had anticipated.

In an ironic note, it was discovered that the then president of the National Association of Realtors,

Thomas Stevens could not sell his home in suburban Virginia after listing it for well over 365 days. In an embarrassing series of interviews he suggested that he would have had better luck had he just listened to his Realtor and lowered the price.

Stevens home continues to stand unsold and at the very same listing price it has had for over 460 days.

In September, The Senate Banking Committee convened a two part hearing on the

housing bubble and

toxic lending demonstrating at the very least that the government was aware that a real systemic risk did in fact exist.

In an unrelated event, the Federal Reserve published the first of a series of

regulatory recommendations that identified specific risk in the home lending market and suggested policy changes that lenders would need to follow in order to carry out the implementation of the Basel II accord that seeks to better manage systemic banking risk.

Some large lenders like Contrywide Financial attempted to side-step the regulations by reorganizing as a thrift thus exempting it from all oversight by the Federal Reserve; others such as

New Century Financial simply accepted the recommendations and implemented them verbatim. Some lenders that had already begun to face unexpectedly large numbers of delinquent and defaulting loans began to

take more extreme measures.

In any case, the reports of widespread regulatory tightening of home lending were in fact coming true leaving millions of potential home buyers and refinancing home owners facing greater scrutiny and lenders facing dramatically lower loan originations.

But still, there was tremendous debate about how long the downturn would last, how deep it would drop and how hard it would hit the overall economy.

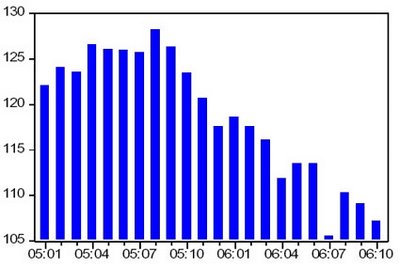

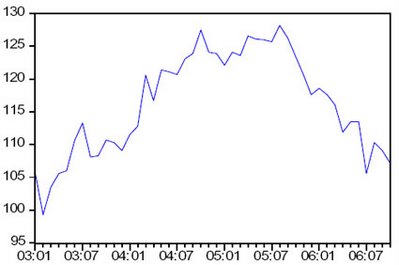

Then, after receiving some

comforting words from none other than former Federal Reserve Chairman Alan Greenspan in October, the sentiment seemed to shift as he suggested that he was seeing a flattening in the purchase applications series published by the Mortgage Bankers Association (MBA).

Many credible sources lined up behind the Greenspan outlook suggesting that a bottom may have been reached and that the worst of the housing decline was in fact already over.

Then,

a bomb was dropped.

Preliminary Q3 GDP came in way under consensus with a major decline to residential fixed investment.

When the final GDP revisions were eventually released it showed that the

housing decline had stripped 1.2 percent from real GDP, the most significant quarterly decline in over 15 years.

The news now seemed to be getting the better of many in the real estate industry causing what appeared to be inconsistent assessments of the current circumstances and even some flaring tempers.

In November, UBS held a yearly home builder conference where the CEO of D.R Horton declared that the current housing market was akin to a “

Death Spiral” while Bob Toll and Ara Hovnanian traded blows over tactics some builders used to move unwanted land.

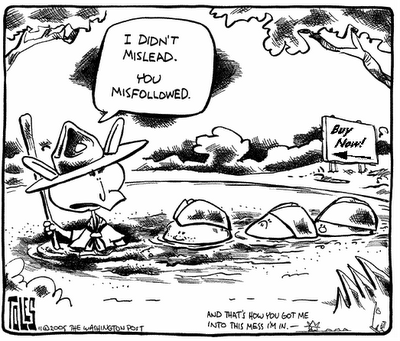

Now it seemed that all the bad news was just too much for the National Association of Realtors to take and in November they decided to go on the offensive by introducing a

$40 million advertising campaign entitled “Buy Now” promoting the idea that “It’s a great time to buy or sell”.

Ironically though, this attempt to persuade buyers and sellers corresponded exactly with the latest survey results from

real estate and home builder practitioners which showed that the men and women in the field felt quite the opposite.

As the year drew to a close, there still existed some significant debate about the fate of the housing market except now the debate centered on how badly things would eventually turn out, a stark difference compared to the debates taking place just a year earlier when many optimistic real estate bulls and economists suggested housing might only experience a limited to no slowing in 2006.

As a possible harbinger of what is in store for 2007, the Federal Reserve modified their final issued statement for 2006 by adding the

single word “substantial” before the following sentence:

“Economic growth has slowed over the course of the year, partly reflecting a substantial cooling of the housing market.”

Now with a new year ahead and a critically important spring selling season the stakes could not be any higher.

The new year will likely show continued slowing and even increasing declines to home sales but what will be more shocking to the average home owner this year will be the dramatic decline of home prices especially in the formerly “hot” regional housing markets.

It’s a one two punch of fantastic proportions as 2006 set up the perfect circumstances of plummeting home sales, bloated inventories and slumping sentiment leaving 2007 poised to tee-off, dropping the US housing market to the canvas for a long and debilitating ten count that may not be overcome for many years or even decades to come.

In an desperate attempt to persuade young students and other residents to stay in Massachusetts rather than seek opportunities in some of the country’s growing and more affordable areas, Massachusetts state legislator Brian A. Joyce recently filled a new piece of legislation that would offer $10,000 for a down payment on a house or condo to those who would stay for at least five years.

In an desperate attempt to persuade young students and other residents to stay in Massachusetts rather than seek opportunities in some of the country’s growing and more affordable areas, Massachusetts state legislator Brian A. Joyce recently filled a new piece of legislation that would offer $10,000 for a down payment on a house or condo to those who would stay for at least five years.